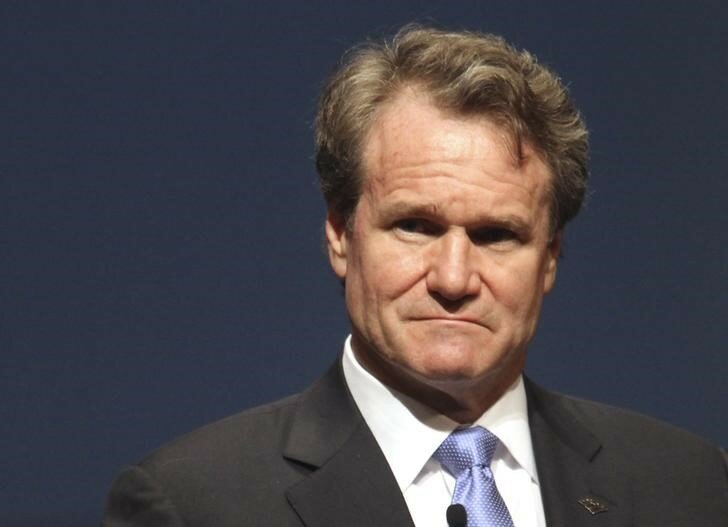

Bank of America CEO Brian Moynihan faces stern test on Tuesday as shareholders decides whether to strip him of his additional role as chairman of the board.

The newspaper reports that the cuts, to be carried out before September 30, are not expected to be as severe as the 2,000 jobs slashed in 2013, sources said. The vote next week came in response to shareholder complaints. “The large institutions will line up with Brian Moynihan”.

In order to handle situation, Bank of America agreed to put the issue to another vote, the results of which will be announced at a special shareholders meeting in Charlotte on Tuesday.

Moynihan has major boosters.

Moynihan does not have much to worry about as Warren Buffett, who doesn’t hold shares of the company but has invested in it says he is doing a “first-class job”. Former Wells Fargo boss Richard Kovacevich and ex-FDIC chair Sallie Krawcheck also publicly supported him. For months, the bank has been busy lobbying shareholders big and small – a distraction from everyday business.

The bank’s shares have dropped thirteen percent in the current, to $15.55, and follows Citigroup, Wells Fargo and JPMorgan Chase. He said that Moynihan has done such a great job cleaning up Bank of America since the financial crisis that he would cast a “for” vote on the proposal if he could.

While Moynihan expects to eke out a victory, the vote is going down to the wire.

The two pension funds leading the charge for the split – the California Public Employees’ Retirement System and the California State Teachers’ Retirement System – say the separate roles allow better oversight of a bank with a troubled history. So far, most people have said yes, Moynihan should lose the chairmanship (and others have said he should be removed from the c-suite entirely while we’re at it).

To Kovacevich, the 2009 shareholder vote at Bank of America to separate the chairman and CEO spots is not important anymore.

The bank maintains that it’s a different company than it was in 2009, having sold off most of the legacy assets from the Countrywide deal that helped spark Lewis’s ouster and the first shareholder revolt.