Particularly when you consider all the risks, externally, and that includes China and volatility coming from China, but also don’t forget the Greeks are going back to the polls on September 20she says.

The USA economy added 173,000 jobs in August, less than expected, while the unemployment rate dropped to 5.1%, surpassing expectations.

Economists had expected the non-farm payroll figures to increase by 220,000 jobs and the unemployment rate to reach a seven-and-a-half year low of 5.2% in August.

A Reuters analysis found that August employment reports between 2005 and 2014 often underestimated jobs growth initially and were revised up by on average 58,000 jobs in the next month’s report.

The euro fell slightly against the dollar, dropping 0.1 percent to $1.1110.

Recent global market shocks have put the Federal Reserve in a bind: Should the central bank try to calm nerves on Wall Street by postponing a long-awaited interest rate hike?

Still, Doll added that this latest round of market volatility should not deter the Fed from raising rates for the first time in almost a decade.

But a tightening labor market and decisions by several state and local governments to raise the minimum wage should eventually translate into faster earnings growth and give the Fed confidence that inflation, which collapsed with oil prices, will move closer to its 2 percent target. What’s more, the Labor Department (excluding annual and benchmark revisions) has marked up its first estimate in subsequent months in eight of the past 10 years. In recent weeks, market expectations of a September rate hike have dimmed because of signs of weakness in the global economy.

Friday is jobs day in America, with the Bureau of Labour Statistics set to release the August employment report at 8:30 a.m. ET.

Paul Ashworth, chief USA economist at Capital Economics, said the report was “fairly mixed and can be used to make a case for or against a rate hike“, adding: “The September meeting is a 50-50 toss-up”. A report out Thursday on non-manufacturing activity – which makes up the bulk of the economy – showed continued strength, suggesting solid underlying growth.

The Fed has said it will increase rates when there is sustained economic recovery.

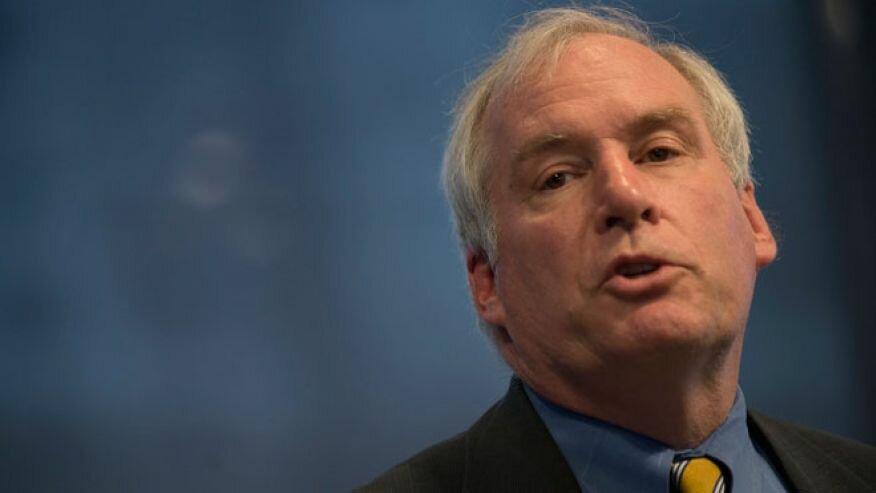

Jeffrey Lacker, president of the Federal Reserve Bank of Richmond, Va., said in a speech to a local retail merchants group that “the Fed has a history of overreacting to financial market movements that seem unconnected to economic fundamentals”.

Such a trend could complicate the Federal Open Market Committee’s reading of the labor market and readiness to lift off from near-zero interest rates. European stock markets were off around 2%, ahead of the key jobs number.

Will the figures stop an interest rate rise?

“I don’t see any evidence that the economy is weak or that we are about to enter a recession”, he wrote to clients. In addition, the response rate from employers to the government’s job survey tends to be low in August.

The dollar trimmed losses against a basket of currencies after the data, while prices for U.S. Treasury debt pared gains.