Considering the industry segments Precision Castparts is involved in, it is apparent; the company makes niche products that have few competitors, if any.

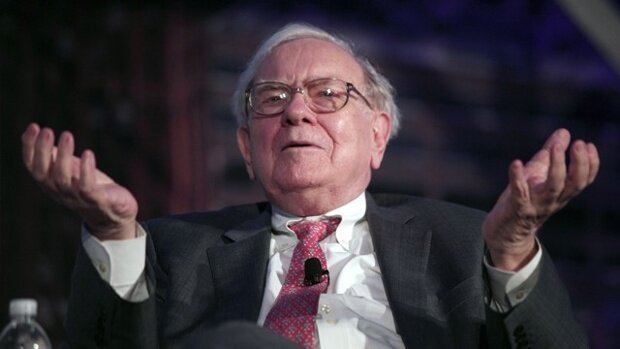

Wall Street was set to open higher on Monday after Warren Buffett’s Berkshire Hathaway agreed to buy Precision Castparts in a deal valued at $37.2 billion, showing the M&A boom was alive and well.

Before the Precision Castparts deal, Buffett’s largest acquisition was rail operator Burlington Northern Santa Fe. Its customer base ranges from airframers such as Boeing, Bombardier, Gulfstream, Bell Helicopter, AgustaWestland, Sikorsky and Airbus, to suppliers such as Goodrich, Triumph, GKN and Rockwell Collins, to numerous other aerospace manufacturers. (NYSE:PCP) anticipated such a development. Precision Castparts shares have dropped 20 per cent this year, hit by declining demand for pipes used by energy companies. As it turns out, investors were bullish on the company, at least according to our data, which includes more than 700 funds.

AES Corporation (AES) rose 6 cents to $12.70 after the electricity producer said total net revenues in the second-quarter ending in June declined 10.4% to $3.86 billion form a year ago period.

Shares of Precision Castparts surged 19 percent, or $37.04, to close at $230.92.

Athens’ main stock market also advanced 2.1 percent on signs that a new Greek bailout deal was on its way, although the Greek market remains down 17 percent since the start of 2015 due to the country’s debt problems.

Buffett in a statement said he has been monitoring Precision for some time, calling it a company he admires. Berkshire has stakes in Coca-Cola, American Express and Mars as well as ownership of reinsurer General Re and clothing maker Fruit of the Loom.

Buffett’s Berkshire Hathaway said it would buy Precision Castparts in a deal valuing the company at $32.3 billion. It also manufactures equipment for oil and gas industries.

But other analysts said the price appeared fair.

Partnered by Brazilian private equity group 3G, Berkshire has orchestrated the merger of food giants Kraft and Heinz and the takeover of Canada’s Tim Horton’s coffee chain by Burger King. Precision has a reputation as a strong performer but its stock has under-performed in recent years in part because of chairman and CEO Mark Donegan’s refusal to give in to calls for more buybacks, preferring instead to use some of his cash to pursue growth.

Berkshire is buying Precision Castparts Corp.